[vc_section css_animation=”appear” css=”.vc_custom_1601345049759{padding-top: 10px !important;}”][vc_row css_animation=”appear”][vc_column][vc_column_text] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

What is a TAX REBATE

If you have been paying tax via PAYE deductions or self assessment it is likely that all the tax calculations have not been accurately recorded with HMRC.

Employee Tax will act on your behalf as your tax agent to recover any excess tax that is due to you

[/vc_column_text][/vc_column][/vc_row][/vc_section][vc_section css_animation=”appear”][vc_row][vc_column][vc_column_text]

Our Professional Services

[/vc_column_text][/vc_column][/vc_row][/vc_section][vc_section][vc_row equal_height=”yes”][vc_column css_animation=”none” width=”1/3″][vc_cta h2=”” txt_align=”center” css_animation=”appear” css=”.vc_custom_1601333713313{border-top-width: 2px !important;border-right-width: 2px !important;border-bottom-width: 2px !important;border-left-width: 2px !important;padding-top: 40px !important;padding-bottom: 30px !important;background-color: #f6f6f6 !important;}”]

Uniform Tax Rebate

You could be due a refund, if you wear uniform or protective clothing to work.

[/vc_cta][/vc_column][vc_column width=”1/3″][vc_cta h2=”” txt_align=”center” css_animation=”appear” css=”.vc_custom_1601333739891{border-top-width: 2px !important;border-right-width: 2px !important;border-bottom-width: 2px !important;border-left-width: 2px !important;padding-top: 40px !important;padding-bottom: 30px !important;background-color: #f6f6f6 !important;}”]

Mileage Tax Rebates

Mileage Refund If work requires you to use your personal vehicle.You may be able to claim

[/vc_cta][/vc_column][vc_column width=”1/3″][vc_cta h2=”” txt_align=”center” css_animation=”appear” css=”.vc_custom_1601335427066{border-top-width: 2px !important;border-right-width: 2px !important;border-bottom-width: 2px !important;border-left-width: 2px !important;padding-top: 40px !important;padding-bottom: 57px !important;background-color: #f6f6f6 !important;}”]

Subscription Tax Refunds

Subscriptions / Professional Fee Tax Rebates

[/vc_cta][/vc_column][/vc_row][vc_row][vc_column width=”1/3″][vc_cta h2=”” txt_align=”center” css_animation=”appear” css=”.vc_custom_1601334858580{border-top-width: 2px !important;border-right-width: 2px !important;border-bottom-width: 2px !important;border-left-width: 2px !important;padding-top: 40px !important;padding-bottom: 58px !important;background-color: #f6f6f6 !important;}”]

Tools Tax Rebate

Claim for purchase / maintenance of Tools

[/vc_cta][/vc_column][vc_column width=”1/3″][vc_cta h2=”” txt_align=”center” css_animation=”appear” css=”.vc_custom_1601335523745{border-top-width: 2px !important;border-right-width: 2px !important;border-bottom-width: 2px !important;border-left-width: 2px !important;padding-top: 40px !important;padding-bottom: 35px !important;background-color: #f6f6f6 !important;}”]

PPI Tax Rebate

You may be entitled to tax refunds on the interest of your successful PPI claim.

[/vc_cta][/vc_column][vc_column width=”1/3″][vc_cta h2=”” txt_align=”center” css_animation=”appear” css=”.vc_custom_1601335179089{border-top-width: 2px !important;border-right-width: 2px !important;border-bottom-width: 2px !important;border-left-width: 2px !important;padding-top: 40px !important;padding-bottom: 30px !important;background-color: #f6f6f6 !important;}”]

Marriage Tax Rebates

Allows you to transfer 10% unused personal allowance .from low earning partner ..

[/vc_cta][/vc_column][/vc_row][/vc_section][vc_section parallax=”content-moving” parallax_image=”2597″ css_animation=”appear”][vc_row][vc_column][vc_column_text]

Reasons for Tax Rebate

-

The most common factors for tax rebates are

-

Pay from your current or previous job Tax Rebate

-

Pension payments Tax Rebate

-

Income from a life or pension annuity Tax Rebate

-

Redundancy payment Tax Rebate

-

Self Assessment tax return Rebate

-

Interest from savings or PPI

-

Foreign income Tax Rebate

-

UK income if you live abroad Rebate

-

Flat Rate Work Expenses inc Job Uniform, Tools, Subscriptions

-

Marriage Allowance Transfer Tax Rebate

[/vc_column_text][vc_btn title=”Calculate Now” shape=”square” color=”juicy-pink” align=”left” link=”url:https%3A%2F%2Femployeetax.co.uk%2Funiform-tax-refunds%2F|||”][/vc_column][/vc_row][/vc_section][vc_section][vc_row css_animation=”appear”][vc_column][vc_column_text]

Our Services

We act on behalf of Taxpayer to claim Tax Rebates from HMRC. We have a service charge for our services but overall we aim to get considerable refunds for our clients and most importantly correct your tax records going forward.

We have Online Calculators for

- Work related expenses inc Job Uniform , Subscriptions , Union Fees

- Marriage Allowance Transfers

- Mileage Rebate

For other Tax Rebate queries we have a General Online Form[/vc_column_text][/vc_column][/vc_row][/vc_section][vc_section][vc_row content_placement=”middle” parallax=”content-moving” parallax_image=”2602″ css_animation=”appear”][vc_column][/vc_column][vc_column][vc_column_text][/vc_column_text][/vc_column][vc_column][vc_column_text][/vc_column_text][/vc_column][vc_column][vc_column_text][/vc_column_text][/vc_column][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row][vc_row css_animation=”appear” css=”.vc_custom_1601338095245{background-color: #f6f6f6 !important;}”][vc_column][vc_column_text]

What Work Related Expenses can I claim ?

Job Uniform

One of the most common work related expenses that most people don`t even realize is washing / maintenance of your Job Uniform.

What Information do I need to claim ?

We just require your basic information and your work history for the last 4 years. All other information we can get from HMRC.

Do I require Receipts ?

No, Job Uniform Tax Rebate is easy to claim and doesn`t require any receipts.

Is there a Deadline for Claims?

You can make a claim anytime but you are only allowed to claim back up-to the last 4 tax years

[/vc_column_text][vc_btn title=”Calculate Now” shape=”square” color=”juicy-pink” align=”left” link=”url:https%3A%2F%2Femployeetax.co.uk%2Funiform-tax-refunds%2F|||”][/vc_column][vc_column][vc_separator color=”black” css_animation=”appear”][/vc_column][/vc_row][vc_row css_animation=”appear” css=”.vc_custom_1601338051621{background-color: #f6f6f6 !important;}”][vc_column][vc_column_text]

What Happens If I Don’t Claim?

These allowances have to be claimed , they are not automatically deducted from your tax bill. If you don’t Claim then you will be paying excess Tax like Millions of other Taxpayers.

Does my Job Uniform Qualify ?

Most jobs where you are required to wear a uniform qualifies for Job Uniform Tax Rebate, some common examples are

-

NHS Employees , Nurses , Porters, Ambulance Drivers ..

-

Airline Employees , Cabin Crew, Air Handlers, Pilots , Check in Staff..

-

Fast Food Employees, Mcdonalds , Burger King , even take away staff..

-

Couriers DHL, FedEX, UPS..

-

Postal Workers …

-

RAC , AA

-

Mechanics

How Much Will I Get

Each profession has been set an Annual Limit by HMRC, Use our Online Calculators for your job.

[/vc_column_text][/vc_column][/vc_row][/vc_section][vc_section][vc_row][vc_column width=”1/2″][vc_column_text css_animation=”appear” css=”.vc_custom_1601342240765{background-color: #dd3333 !important;}”]

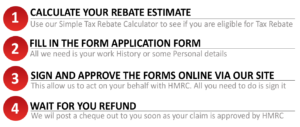

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more

[/vc_column_text][/vc_column][vc_column css_animation=”appear” width=”1/2″][vc_column_text css=”.vc_custom_1601341877557{padding-top: 30px !important;}”] [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_btn title=”Calculate Now” shape=”square” color=”juicy-pink” size=”lg” align=”center” css_animation=”appear” button_block=”true” link=”url:https%3A%2F%2Femployeetax.co.uk%2Funiform-tax-refunds%2F|||”][/vc_column][/vc_row][/vc_section]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_btn title=”Calculate Now” shape=”square” color=”juicy-pink” size=”lg” align=”center” css_animation=”appear” button_block=”true” link=”url:https%3A%2F%2Femployeetax.co.uk%2Funiform-tax-refunds%2F|||”][/vc_column][/vc_row][/vc_section]